Risk Management

Overall Risk Management

1. Risk Management System

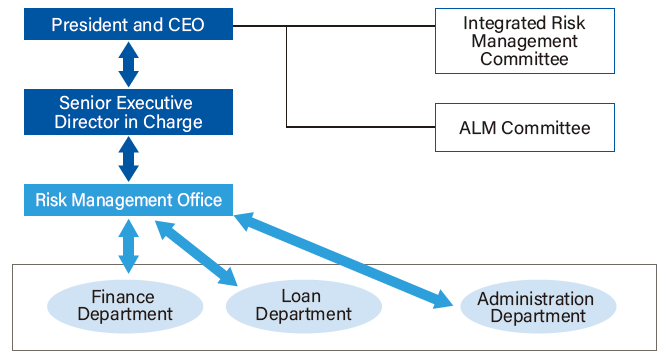

JFM adopts an integrated risk management approach to respond to various risks, while pursuing a higher level of risk analysis and management.

Accordingly, JFM has developed a system for appropriate risk management, including the establishment of the Integrated Risk Management Committee, which supervises JFM's overall risk management, and the Risk Management Office, to ensure comprehensive risk management. Risk management can then be appropriately reflected in management decisions.

2. Characteristics of JFM's Risks

JFM lends to local governments with the maximum maturity of 40 years while JFM raises funds primarily by issuing 10-year bonds. Among other risks, JFM considers the interest rate risk associated with bond refinancing as its major risk (the risk of the negative margin caused by the interest payable exceeding the interest receivable).

To address such interest rate risk, JFM maintains reserves to absorb interest rate fluctuations (the Reserve for Interest Rate Volatility) and has set up the ALM Committee to comprehensively analyze and manage JFM’s assets and liabilities in a timely and appropriate manner.

The ALM Committee conducts medium-term and long-term management and risk analysis through scenario analysis, VaR analysis, duration analysis, and other analyses. JFM reflects the findings in its bond issuance plans and other aspects of management and endeavors to lower interest rate risk.